An expense account isn’t a catch-all for every financial transaction a company makes. While expenses are the costs of running the business, like rent, salaries, and supplies, there’s a whole other category for financial activity that affects a company’s financial picture but doesn’t directly eat into profits. These are called non-expense accounts.

Think you know where all your company’s money goes, There’s more to the story than expenses! Dive into the world of non-expense accounts.

Expense accounts track a company’s everyday costs, but not everything is an expense! Non-expense accounts hold other financial activity that affects a company’s well-being, like investments or loan repayments.

Which Is Not An Expense Account?

Expense accounts are like the cash register of your business – they track the money you spend to keep things running. Rent, salaries, and office supplies? All expenses. But what about things you buy that aren’t used up right away, or money that flows in and out for reasons other than daily operations? These fall under non-expense accounts.

Defining Not An Expense Account

Straightforward

- An expense account tracks the money your business spends to operate day-to-day (salaries, rent, etc.). Not an expense account, however, reflects financial activity that impacts your company’s overall well-being but doesn’t directly affect its profitability. Think of it as a different category altogether, like investments or loan repayments.

Analogy

- Imagine your business is a house. Expense accounts are like the utility bills – the ongoing costs of keeping the lights on and the water running. But what about buying furniture or making a down payment on the house itself? Those wouldn’t be utility bills – they’d be non-expense accounts, impacting your financial situation without affecting your day-to-day living (operating) costs.

Differentiating Expenses vs. Non-expenses

Expenses and non-expenses are two sides of the financial coin for a business. While they both involve money moving in and out, they serve distinct purposes in understanding a company’s financial health. Here’s how they differ:

Expenses

Think of them as the fuel

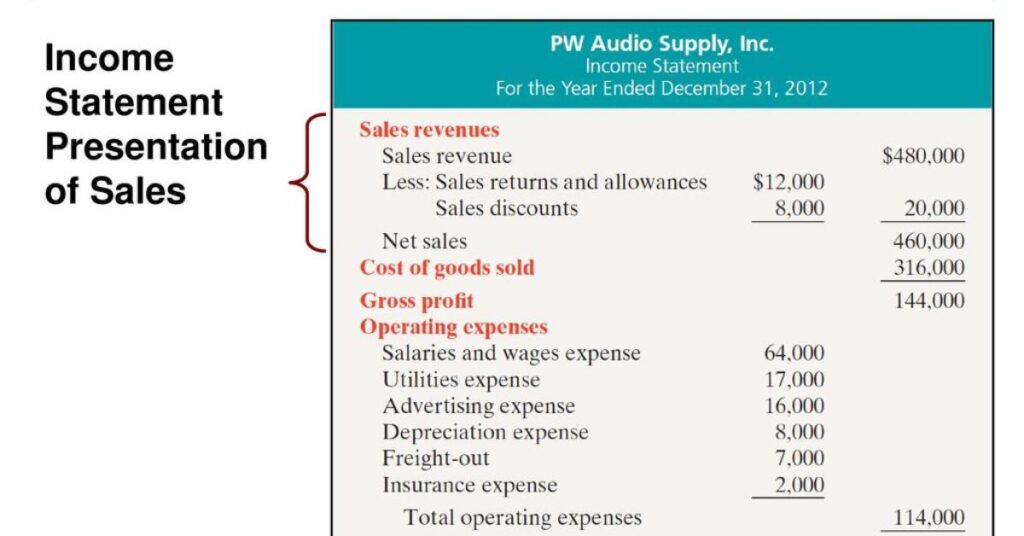

Expenses are the cost of doing business. They represent the cash a company spends on its day-to-day operations to generate revenue. Examples include:

- Salaries and wages

- Rent and utilities

- Office supplies

- Marketing costs

- Raw materials

Direct impact on profitability

Expenses are deducted from a company’s revenue to calculate net income, also known as the profit or loss. The lower the expenses compared to revenue, the higher the profitability.

Non-expenses

A broader view of financial health

Non-expenses represent financial activities that affect a company’s financial position but don’t directly impact its profitability. They paint a broader picture of the company’s financial well-being. Examples include:

- Investment accounts (stocks, bonds, real estate)

- Asset accounts (equipment, property, intellectual property)

- Loan accounts (repayments on loans)

- Owner’s equity accounts (investment by owners)

Indirect impact

Non-expenses don’t directly affect profitability, but they influence a company’s financial flexibility, liquidity, and long-term growth potential.

Here’s an analogy: Imagine a bakery.

Expenses

The flour, sugar, eggs, and salaries of the bakers are all expenses because they’re directly used to produce goods (bread) and generate revenue (sales).

Non-expenses

Buying a new oven (an asset) or paying back a loan (loan account) wouldn’t be an expense. These activities impact the bakery’s financial well-being (ability to bake more efficiently or reduce debt), but they don’t directly affect the cost of producing a loaf of bread.

Understanding the difference between expenses and non-expenses is crucial for accurate financial reporting and informed decision-making. It helps businesses:

See the bigger picture

By analysing both expenses and non-expenses, businesses gain a more comprehensive understanding of their financial health.

Make smarter choices

Knowing how much is invested in assets or loans can help businesses make strategic decisions about resource allocation and future investments.

Maintain compliance

Accurate categorization of expenses and non-expenses ensures adherence to accounting standards and regulations.

Recomended post: How to Easily Add Money to Your Venmo Account? All know about in detailed

Examples of Non-expense Accounts

Investment Accounts

This category reflects a company’s forward-thinking approach. It encompasses funds allocated for future growth, such as stocks, bonds, or real estate investments. These investments hold the potential to generate future income but aren’t considered expenses as they haven’t been used up yet.

Asset Accounts

These accounts represent the valuable possessions a company owns for the long term. They include tangible assets like equipment, furniture, and buildings, as well as intangible assets like patents or trademarks. The value of these assets is tracked in non-expense accounts, not as expenses, because they’re expected to benefit the company over multiple operating cycles.

Loan Accounts

When a company takes out a loan, the money received isn’t considered income because it needs to be repaid eventually. Loan accounts track how much principal has been paid back towards the loan. Repayments aren’t expenses, but they do impact the company’s financial picture by reducing its liabilities.

Owner’s Equity Accounts

These accounts reflect the financial contributions made by the company’s owners or shareholders. This could be the initial investment used to start the business or additional funds injected for growth. Owner’s equity isn’t an expense; it’s a source of funding that contributes to the company’s financial strength.

By understanding these non-expense accounts, businesses gain valuable insights into their financial health beyond just profit and loss. This knowledge empowers them to make informed decisions, maintain accurate financial records, and ensure compliance with accounting regulations.

Importance of Understanding Non-expense Accounts

Non-expense accounts might seem like a distant corner of bookkeeping, but they hold immense significance for a company’s financial well-being. Here’s why understanding them is crucial:

1. Accurate Financial Reporting

Separating expenses from non-expenses paints a crystal-clear picture of a company’s financial health. It ensures financial statements aren’t cluttered with misleading information. This transparency is vital for stakeholders like investors, creditors, and regulators.

2. Smarter Business Decisions

Non-expense accounts act like a financial compass. By analysing them, businesses can assess their financial flexibility. They gain insights into investments made (asset accounts) and debts incurred (loan accounts). This knowledge empowers them to make strategic decisions regarding resource allocation, funding strategies, and future investments.

3. Investor and Regulatory Trust

Financial statements are a window into a company’s financial health. When these statements accurately reflect non-expense accounts, it builds trust with investors. They gain confidence in the company’s financial transparency, which can translate to better access to capital and funding opportunities. Additionally, proper classification ensures adherence to accounting standards and regulations, avoiding any potential penalties or legal issues.

4. Long-Term Growth Potential

Non-expense accounts aren’t just about the present; they’re indicators of future potential. Asset accounts, for example, showcase the resources a company has at its disposal for future production and revenue generation. Understanding these accounts allows businesses to plan for long-term growth and make strategic investments for a sustainable future.

How Non-expense Accounts Impact Financial Statements?

Non-expense accounts play a vital role in shaping a company’s financial statements, providing a more comprehensive view of its financial health beyond just profitability. Here’s how they leave their mark:

- Separate Categories

Unlike expenses that get lumped together under one heading, non-expense accounts have distinct categories within the balance sheet. This segregation ensures clarity and transparency. For instance, there might be sections for investments, property, plant & equipment, and owner’s equity, each showcasing a specific aspect of the company’s financial picture.

- Asset Valuation

Asset accounts directly impact the total assets reported on the balance sheet. These accounts reflect the value of a company’s long-term holdings, like equipment, buildings, or intellectual property. By understanding these values, stakeholders can assess the company’s resource base and potential for future growth.

- Liability Tracking

Loan accounts play a crucial role in tracking a company’s liabilities. They show how much principal has been repaid on loans and how much debt the company still owes. This information is vital for creditors and investors to gauge the company’s financial leverage and risk profile.

- Owner’s Equity

Owner’s equity accounts are reflected in the shareholder’s equity section of the balance sheet. They represent the total amount of money invested by the owners in the business. This showcases the financial commitment of the owners and their stake in the company’s success.

Non-expense accounts paint a more complete picture than just expenses alone. They provide valuable insights into a company’s financial resources (assets), funding sources (owner’s equity), and financial obligations (loans). This comprehensive view helps stakeholders make informed decisions about the company’s financial stability and future prospects.

Accounting Treatment of Non-expense Items

Separate Recording

Unlike expenses that flow directly into the income statement, non-expense items are recorded in distinct accounts within the balance sheet. This segregation ensures clarity and avoids cluttering the income statement with non-cash flow related activities.

Matching Principle

The accounting principle of matching dictates that expenses incurred to generate revenue should be recognized in the same period as the revenue. However, non-expense items don’t directly generate revenue. For specific accounts, there might be adjustments made to reflect their impact over time.

Asset Valuation

For asset accounts, the initial purchase price of the asset is recorded. Over time, depreciation might be applied to gradually spread the cost of the asset over its useful life. This depreciation expense is reflected in the income statement, but the asset itself remains on the balance sheet at its net book value (original cost minus accumulated depreciation).

Liability Tracking

Loan accounts track the principal portion of loan repayments. These repayments aren’t expenses; instead, they reduce the company’s total liabilities on the balance sheet. Interest payments on loans, however, are considered expenses as they represent the cost of borrowing money and are recorded in the income statement.

Owner’s Equity

This account reflects the total amount of owner investment and doesn’t flow through the income statement.

Understanding these accounting treatments helps ensure financial statements accurately portray a company’s financial health. It highlights the distinction between:

Cash Flow

Non-expense items often don’t involve a direct cash outflow in the current period.

Profitability

Non-expense items don’t directly impact a company’s current profitability as reflected in the income statement. However, they can influence future profitability through factors like asset value or debt obligations.

Why Tracking Non-expense Accounts is Crucial

Beyond the Profit & Loss

1. Crystal-Clear Financial Picture

Imagine a financial statement focused solely on expenses – it’s like looking at a car’s speedometer without the gas gauge. Non-expense accounts provide the fuel tank information. They reveal a company’s assets (investments, equipment), liabilities (loans), and owner contributions, giving a complete view of financial well-being.

2. Smarter Decisions, Brighter Future

Non-expense accounts are a treasure trove of insights for strategic decision-making. By analysing investments and liabilities, businesses can assess their financial flexibility. Is there room for expansion? Can more debt be handled? These insights guide future investments and resource allocation for sustainable growth.

3. Trustworthy Image for Stakeholders

Financial statements are a company’s report card for investors, creditors, and regulators. This builds trust with stakeholders, potentially leading to better access to capital and funding opportunities.

4. Avoiding Costly Missteps

Inattention to non-expense accounts can lead to financial pitfalls. Forgetting to track depreciation on equipment can overstate profits. Mishandling loan repayments can lead to missed payments and penalties. Accurate tracking minimise these risks and ensures compliance with accounting regulations.

5. Long-Term Growth on the Horizon

Non-expense accounts aren’t just a snapshot of the present; they’re a roadmap to the future. Asset accounts showcase the resources available for future production. Understanding these resources allows businesses to plan for long-term growth and make strategic investments for a sustainable future.

Challenges in Identifying Non-expense Accounts

Separating the Wheat from the Chaff

- Transaction Classification Complexity

Not every financial transaction falls neatly into an “expense” or “non-expense” category. There can be grey areas. Distinguishing such nuances requires careful analysis.

- Lack of Standardised Practices

Inconsistency in applying these guidelines can lead to misclassification of non-expense accounts.

- Incomplete or Inaccurate Records

Accurate tracking starts with good record-keeping. Missing receipts, invoices, or unclear descriptions in financial records can make it difficult to categorise transactions accurately. Incomplete information creates confusion and increases the risk of misclassifying non-expense accounts.

- Internal Expertise Gap

Properly identifying non-expense accounts can require a strong understanding of accounting principles. Smaller businesses might not have the in-house expertise to navigate these complexities. Relying solely on bookkeeping software without proper accounting knowledge can lead to errors.

- Evolving Business Landscape

Business models and financial instruments are constantly evolving. New types of investments or financing options might emerge that don’t fit neatly into traditional non-expense account categories. Keeping up-to-date with these changes is crucial for accurate identification.

By addressing these challenges, businesses can ensure their non-expense accounts are properly identified, leading to accurate financial statements, informed decision-making, and a robust foundation for long-term success.

Tips for Properly Managing Non-expense Accounts

Keeping Your Financial House in Order

1. Establish a Clear Chart of Accounts

Think of this as your financial roadmap. A well-defined chart of accounts outlines all the accounts used in your accounting system, including distinct categories for non-expense accounts like investments, assets, loans, and owner’s equity. This provides a clear framework for accurate classification.

2. Maintain Meticulous Records

Every financial transaction, big or small, tells a story. Develop a system for recording each transaction with clear details, including the amount, date, and a concise description. Attach relevant documentation like invoices or receipts. These detailed records become your source of truth when classifying non-expense accounts.

3. Embrace Automation (the Right Way)

Accounting software can be a powerful tool for managing non-expense accounts. Leverage features like automatic transaction categorization, but don’t rely solely on them. Always double-check classifications, especially for complex transactions, to avoid errors.

4. Conduct Regular Reconciliations

Think of this as a financial checkup. Regularly reconcile your non-expense accounts with external sources like bank statements or loan statements. This process helps identify any discrepancies or errors in classification, ensuring the accuracy of your financial records.

5. Seek Professional Help When Needed

Don’t be afraid to call in the experts. Consulting a qualified accountant can be invaluable for navigating the complexities of non-expense accounts. They can provide guidance on proper classification, ensure adherence to accounting standards, and offer valuable insights for strategic decision-making.

6. Stay Up-to-Date with Accounting Standards

The world of accounting isn’t static. Accounting standards and best practices can evolve over time. Make it a habit to stay informed about any changes that might impact the classification or treatment of non-expense accounts.

- Enhanced Financial Reporting:

Accurate classification ensures financial statements present a clear and transparent picture of a company’s financial health.

- Informed Decision-Making:

Having a clear understanding of a company’s non-expense accounts empowers leaders to make informed strategic decisions about investments, resource allocation, and future growth.

- Improved Compliance:

Proper management minimises the risk of errors or misclassifications, ensuring adherence to accounting standards and regulations.

- Stronger Stakeholder Relationships:

Transparency in financial reporting builds trust with investors, creditors, and regulators, fostering stronger relationships and potentially leading to better access to capital and funding opportunities.

Remember, effectively managing non-expense accounts isn’t just about ticking boxes; it’s about gaining valuable insights into your company’s financial well-being and paving the way for a secure and sustainable future.

Techniques for Accurate Reporting of Non-expenses

Building Trust Through Transparency

Non-expense accounts play a crucial role in portraying a company’s financial health beyond just profitability. Ensuring their accurate reporting builds trust and transparency with stakeholders. Here are some key techniques to achieve this:

1. Establish Clear Internal Guidelines

- Develop a comprehensive chart of accounts that clearly defines each non-expense category (investments, assets, loans, etc.) with specific examples.

- Create internal documentation outlining the criteria for classifying transactions into non-expense accounts. This ensures consistency and reduces the risk of misclassification.

- Train your accounting team on these guidelines and provide ongoing updates as accounting standards or best practices evolve.

2. Maintain Robust Recordkeeping Practices

- Implement a system for capturing every financial transaction with clear details: amount, date, description, and supporting documentation (invoices, receipts).

- Standardise the format and terminology used in recording transactions to avoid confusion. This simplifies the process of classifying non-expense accounts.

- Regularly back up your financial records to ensure data security and facilitate easy retrieval for audits or reconciliations.

3. Leverage Automation with Caution

- Accounting software with auto-categorization features can streamline data entry.

- Human oversight remains crucial for accurate non-expense account reporting.

4. Conduct Regular Reconciliations

- Regularly reconcile your non-expense accounts with external sources (bank statements, loan statements, etc.) to identify discrepancies.

- Discrepancies might highlight potential errors in classification or data entry. Promptly investigate and correct any issues to ensure the accuracy of your financial records.

5. Seek Professional Guidance

- Partnering with a qualified accountant is invaluable for complex situations. They can provide expert advice on:

- Proper classification of non-expense accounts based on accounting standards.

- Implementing best practices for accurate reporting.

- Maintaining compliance with relevant regulations.

6. Prioritise Transparency in Financial Reporting

- Ensure your financial statements clearly distinguish between expenses and non-expense accounts.

- Provide detailed disclosures and notes explaining the nature and valuation of significant non-expense accounts.

- Encourage open communication with stakeholders and address any questions or concerns regarding non-expense accounts.

Enhanced Credibility:

Stakeholders gain confidence in a company’s financial transparency, fostering trust and potentially leading to better access to funding.

Improved Decision-Making:

Accurate non-expense reporting provides a clearer picture of financial health, empowering leaders to make informed decisions about investments, growth strategies, and resource allocation.

Reduced Risk:

Minimised errors and misclassifications reduce the risk of financial penalties or legal issues stemming from non-compliance with accounting standards.

Legal and Regulatory Considerations for Non-expense Accounts

1. Adherence to Accounting Standards

- Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS) provide the framework for financial reporting.

- These standards establish guidelines for classifying and valuing non-expense accounts like investments, assets, loans, and owner’s equity.

- Failing to adhere to these standards can lead to inaccurate financial statements, potentially impacting investor confidence and regulatory compliance.

2. Focus on Materiality

- Not every minor transaction requires an extensive accounting treatment. The principle of materiality comes into play.

- Materiality refers to information that could reasonably influence the decisions of investors or creditors.

3. Disclosure Requirements

- Companies are obligated to disclose certain information about non-expense accounts in their financial statements.

- The specific disclosure requirements might vary depending on the accounting standards used and the size and complexity of the company.

4. Recordkeeping and Documentation

- Companies are required to maintain accurate and complete records of all financial transactions, including those related to non-expense accounts.

- These records should include supporting documentation like invoices, receipts, and contracts.

5. Internal Controls and Audit Trail

- Companies need to have internal controls in place to ensure the accuracy and integrity of their non-expense account data.

- This might involve implementing processes for reviewing and approving transactions, segregating accounting duties, and conducting regular reconciliations.

- A clear audit trail allows auditors to trace transactions and verify the accuracy of non-expense account reporting.

6. Tax Implications

- Certain non-expense accounts can have tax implications for a company.

- Consulting with a tax advisor is crucial to understand how non-expense accounts might impact a company’s tax liability.

7. Stay Updated on Changing Regulations

- Accounting standards and regulations can evolve over time. Companies need to stay informed about any changes that might impact the classification or treatment of non-expense accounts.

Potential Risks Associated with Non-expense Accounts

Keeping a Watchful Eye

1. Misclassification Errors

- Inaccurate classification of transactions can have a ripple effect.

- Misclassifications can mislead stakeholders about a company’s financial health and profitability.

2. Fraudulent Activity

- Non-expense accounts can be a target for fraudulent activities.

- Robust internal controls and a culture of ethical conduct are crucial to mitigate the risk of fraud related to non-expense accounts.

3. Compliance Issues

- Non-adherence to accounting standards or regulations regarding non-expense accounts can lead to hefty fines or legal repercussions.

4. Decision-Making Missteps

- Inaccurate or misleading information about non-expense accounts can lead to poor financial decisions.

- Relying on accurate and transparent non-expense account data empowers leaders to make informed decisions for sustainable growth.

5. Reputational Damage

- Financial misstatements stemming from non-expense account issues can severely damage a company’s reputation. Investors lose trust, and business relationships can suffer.

- Maintaining transparency and accurate reporting of non-expense accounts is essential for building and maintaining a strong reputation.

Mitigating these risks requires a proactive approach

- Invest in Training

Equipping accounting staff with a solid understanding of non-expense account classification and best practices is crucial.

- Implement Strong Internal Controls

Develop clear procedures for reviewing and approving transactions, segregating accounting duties, and conducting regular reconciliations.

- Maintain Detailed Records

Keep meticulous records with supporting documentation for all financial transactions related to non-expense accounts.

- Seek Professional Help

Don’t hesitate to consult a qualified accountant for complex situations or to ensure compliance with accounting standards.

- Prioritise Transparency

Strive for clear and accurate communication with stakeholders regarding the nature and valuation of non-expense accounts.

By being aware of these potential risks and taking proactive steps to mitigate them, companies can harness the true potential of non-expense accounts for informed decision-making, building trust, and achieving long-term financial success.

FAQ’s

What Is Not An Expense Account?

Not an expense account refers to transactions or items that don’t directly affect a company’s profitability or operational expenses. These include investments, asset purchases, loan repayments, and owner withdrawals.

What is an expense account?

An expense account is a financial record used to track costs incurred by a company during its normal operations. It includes expenses such as rent, utilities, salaries, supplies, marketing, advertising, travel, and entertainment.

Which of the following is not an expense?

Investments, asset purchases, loan repayments, and owner withdrawals are not considered expenses.

Which item is not an expense?

Non-expense items include investments, asset purchases, loan repayments, and owner withdrawals.

What is included in an expense account?

Expenses such as rent, utilities, salaries, supplies, marketing, advertising, travel, and entertainment are included in an expense account.

Conclusion

These accounts, like investments, assets, loans, and owner’s equity, offer valuable insights into a company’s financial health, resource allocation, and future potential. Understanding these non-expense accounts empowers businesses to make informed decisions, build trust with stakeholders, and navigate the path towards long-term financial success.

By demystifying these accounts, businesses unlock a treasure trove of information that strengthens their financial foundation and paves the way for a secure future.

I am constantly seeking new challenges and opportunities to make a positive impact through my work. With my passion for innovation and drive for success, i continues to push the boundaries of what is possible in the ever-evolving world of technology.

In addition to my technical skills, I am known for my strong communication and leadership abilities. I thrives in collaborative environments, where i can leverage my expertise to drive projects forward and inspire teams to achieve their goals.