Wondering how long it takes to inherit a 403(b) account? Let’s delve into the timeline and process of inheriting this type of retirement account.

Curious about the timeline for inheriting a 403(b) account? Let’s unravel the mystery and explore just how long it takes to gain access to these retirement funds. Inheriting a 403(b) account can be a process that varies depending on several factors. Beneficiaries can expect to gain access to the funds within a few weeks to a few months after the account holder’s passing.

The exact timeline may be influenced by factors such as the completion of necessary paperwork, verification of beneficiary status, and any specific requirements outlined by the financial institution holding the account. It’s essential for beneficiaries to communicate promptly with the account administrator to expedite the process and ensure a smooth transition of the inherited assets.

Recomended post: https://financequasar.com/why-is-my-tinder-account-under-review/

Account options

1: Keep the beneficiary account with WEA Member Benefits

Keeping the beneficiary account with WEA Member Benefits, Means that the beneficiary has the choice to maintain the inherited account with WEA Member Benefits, the organisation managing the account.

Am I an eligible designated beneficiary?

queries whether the beneficiary qualifies as an eligible designated beneficiary under the account’s rules and regulations.

What are my required distributions?

inquires about the mandatory withdrawals or distributions that the beneficiary must take from the inherited account according to the account’s guidelines and IRS regulations.

2: Transfer/rollover 403(b) assets to an inherited IRA

Transfer/rollover 403(b) assets to an inherited IRA means that beneficiaries have the choice to move the assets from the inherited 403(b) account into an inherited Individual Retirement Account (IRA).

Can I transfer or rollover the beneficiary account to a different custodian?

Asks whether it’s possible for the beneficiary to move the inherited account to another financial institution or custodian.

Can I roll the account into my retirement account?

Inquires whether the beneficiary can merge the inherited 403(b) account with their existing retirement account, such as an IRA or another retirement plan.

3: Liquidate the account

Liquidating the account means that beneficiaries have the choice to sell or convert the assets held in the inherited 403(b) account into cash. This involves closing the account and receiving the funds as a lump sum payment.

4: Disclaim the account

Disclaim the account means that beneficiaries have the option to refuse or renounce their rights to inherit the 403(b) account. This process is known as disclaiming the account.

When must I notify you of my intention to disclaim?

Asks about the deadline or timeframe within which the beneficiary must inform the relevant parties, such as the account administrator or custodian, of their decision to disclaim or refuse the inheritance.

Keeping your account with WEA Member Benefits

Keeping your account with WEA Member Benefits means choosing to maintain the inherited account with WEA Member Benefits, the organisation responsible for managing the account.

Recomended post: How to Easily Add Money to Your Venmo Account? All know about in detailed

What are the advantages to retaining the account with WEA Member Benefits

Asks about the benefits or perks associated with keeping the inherited account with WEA Member Benefits rather than transferring it elsewhere.

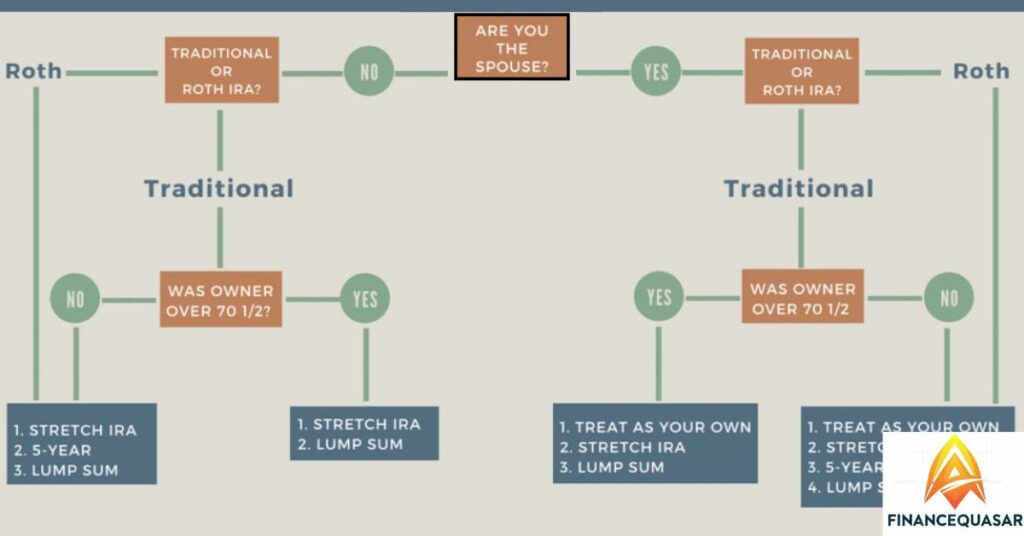

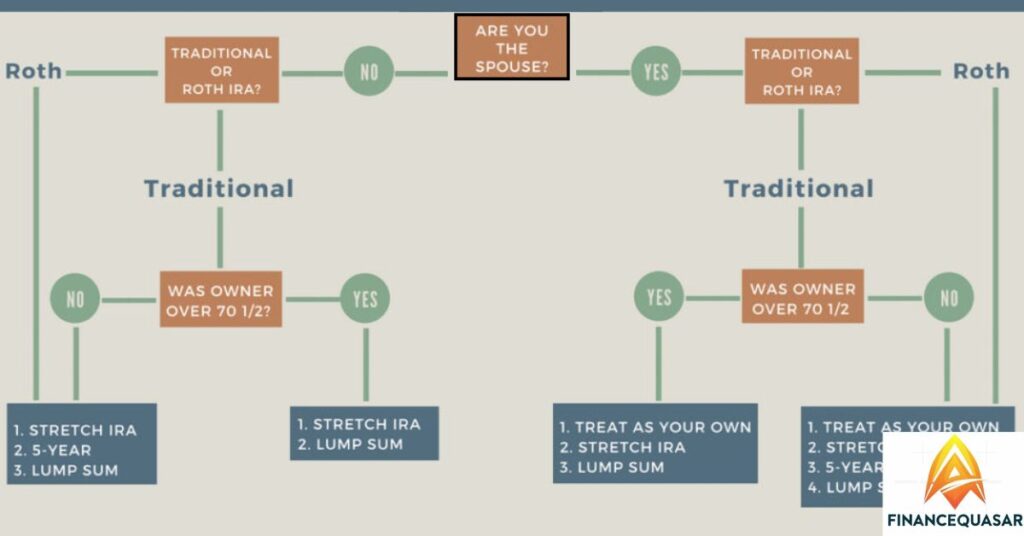

Distribution Rules for Inherited Retirement Plan Assets

| Scenario | Distribution Rules |

| Death Before Required Beginning Date (RBD) | Spouse as Sole Primary Beneficiary: Options include distributing over life expectancy or taking RMDs. <br> – Non-Spouse Person and/or Spouse Among Multiple Beneficiaries: Assets must be distributed within 10 years. <br> – Nonperson Beneficiary: Must distribute full balance within five years. |

| Death After Required Beginning Date (RBD) | Spouse as Sole Primary Beneficiary: Distribute over life expectancy of spouse or remaining life expectancy of deceased, whichever is longer. <br> – Non-Spouse Person and/or Spouse Among Multiple Beneficiaries: Assets must be distributed over 10 years. <br> – Nonperson Beneficiary: Assets must be distributed over next 10 years. |

Spouse as Sole Primary Beneficiary

When the deceased’s spouse is the sole primary beneficiary of a retirement account, they have flexibility in distributing the assets. They can choose to take distributions over their life expectancy, withdraw a lump sum, or roll over the assets into their own account.

The timing of distributions may depend on factors like the age of the deceased and applicable laws, such as the RMD age. This option offers the spouse control over how and when they receive the inherited funds, allowing for financial planning aligned with their needs and goals.

Non-Spouse Person and/or Spouse Among Multiple Beneficiaries

When there are multiple beneficiaries of a retirement account, including a non-spouse individual, or if the spouse is not the sole beneficiary, different distribution rules apply. In such cases, the options for distributing the assets may be more restricted compared to when the spouse is the sole primary beneficiary.

Non-spouse beneficiaries may need to follow specific guidelines outlined by the retirement plan or applicable laws, such as the SECURE Act, which may require assets to be distributed within a certain timeframe, almost within 10 years of the original account holder’s death.

These rules ensure fair distribution among beneficiaries and adherence to legal requirements governing inherited retirement assets.

Nonperson Beneficiary

A “Nonperson Beneficiary” refers to an entity, such as an estate or a charitable organisation, designated to inherit retirement account assets. Unlike individual beneficiaries, nonperson beneficiaries have specific rules governing the distribution of inherited funds.

Nonperson beneficiaries must distribute the entire account balance within a specified timeframe, such as by the end of the fifth year following the original account owner’s death.

The distribution timeline and taxation may vary based on factors like the date of death and applicable regulations.This designation ensures that the assets from the retirement account are distributed according to the wishes or purposes outlined by the deceased account holder.

Death After the Required Beginning Date

Death After the Required Beginning Date refers to a scenario where the owner of a retirement account passes away after reaching the Required Beginning Date (RBD).

In this situation, the options available to beneficiaries for distributing the inherited assets depend on various factors, including the relationship between the beneficiary and the deceased account holder.

For instance, if the sole primary beneficiary is the spouse, they may have different distribution options compared to non-spouse beneficiaries or multiple beneficiaries.

The rules regarding the distribution timeline and taxation may differ based on the specific circumstances surrounding the death of the account holder.

Spouse as Sole Primary Beneficiary

“Spouse as Sole Primary Beneficiary” refers to a situation in which the spouse of the deceased individual is the only designated beneficiary of a retirement account. In such cases, the spouse has specific options for managing the inherited account.

They may choose to distribute the assets in various ways, such as taking a lump sum, receiving distributions over their life expectancy, or rolling over the funds into their own IRA.

The rules governing these options may vary depending on factors such as the age of the deceased individual at the time of death and any applicable regulations or legislation, such as the Secure Act.

Non-Spouse Person and/or Spouse Among Multiple Beneficiaries

“Non-Spouse Person and/or Spouse Among Multiple Beneficiaries” refers to scenarios where the beneficiaries of a retirement account include individuals other than the spouse of the deceased account holder, or where there are multiple beneficiaries including the spouse.

In such cases, the distribution options for the inherited account may differ from those available to a spouse as the sole primary beneficiary. The distribution rules may depend on various factors such as the age of the beneficiaries, the relationship to the deceased account holder, and any applicable laws or regulations governing retirement accounts.

These rules may include options such as distributing the assets over a certain period or taking a lump sum payment, subject to specific conditions and requirements.

Nonperson Beneficiary

A “Nonperson Beneficiary” refers to a situation where an individual designates an entity other than a person, such as an estate or a charity, as the beneficiary of their retirement account. In the context of inherited retirement plan assets, if the designated beneficiary is a nonperson entity, specific distribution rules apply.

The nonperson beneficiary must distribute the entire balance of the inherited retirement account by a certain deadline, often within a specified timeframe, such as the fifth year following the year of the original account holder’s death.

These distribution rules ensure that the assets held in the retirement account are properly transferred to the designated nonperson entity according to legal requirements and tax regulations.

Distribution options

This refers to the various choices available to the beneficiary regarding how to receive the funds from the inherited retirement account.

Are income taxes withheld from my taxable distribution?

This question addresses whether taxes are automatically deducted from distributions that are subject to taxation. It’s important to know if taxes will be withheld upfront to plan for potential tax liabilities.

When can I withdraw money from the beneficiary account?

This question seeks clarification on the timing of when the beneficiary can access the funds held in the inherited account.

Why do I have to take required distributions?

This question aims to understand the reasoning behind the requirement for beneficiaries to take distributions from the inherited account.

Taxation

Are distributions from my inherited account taxable?

This question addresses whether the distributions received from the inherited retirement account are subject to taxation.

Roth IRA Beneficiary Options

The options available to beneficiaries of Roth IRAs, detailing how distributions from these accounts are treated differently from traditional IRAs for tax purposes.

A Plan Can Have Its Own Distribution Provisions

The flexibility of retirement plans to establish their own distribution rules, which may differ from the standard regulations set forth by tax laws.

Do Beneficiaries Pay Taxes on IRAs?

Whether beneficiaries are required to pay taxes on inherited IRAs, providing clarity on the tax implications for beneficiaries.

What Do You Do if You’ve Inherited an IRA?

Actions and decisions that beneficiaries should consider when they inherit an IRA, including potential tax obligations and distribution options.

What Is the IRA 10-Year Rule?

The IRA 10-Year Rule, which mandates that beneficiaries must fully deplete inherited IRA accounts within a 10-year period, with exceptions for certain eligible designated beneficiaries.

FAQs

1. What is a 403(b) account?

A 403(b) account is a retirement savings plan for certain employees of public schools, tax-exempt organisations, and certain ministers.

2. Who can inherit a 403(b) account?

Generally, designated beneficiaries named by the original account holder can inherit a 403(b) account.

3. What are the options for inheriting a 403(b) account?

Beneficiaries can typically keep the account, transfer it to an inherited IRA, liquidate it, or disclaim it.

4. Are distributions from an inherited 403(b) account taxable?

Yes, distributions from an inherited 403(b) account are generally taxable as income.

5. Can I roll over an inherited 403(b) account into my own retirement account?

No, non-spouse beneficiaries cannot roll over an inherited 403(b) account into their own retirement account.

6. What are required minimum distributions (RMDs) for inherited 403(b) accounts?

Non-spouse beneficiaries typically must distribute the assets within 10 years of the original account owner’s death, while spouses have different distribution options.

7. What are the advantages of retaining the account with WEA Member Benefits?

Retaining the account with WEA Member Benefits offers benefits like transaction-free distributions, flexible distribution options, and personal assistance from representatives.

Conclusion

The process of inheriting a 403(b) account involves understanding the various options available and their implications. Whether choosing to keep the account, transfer it to an inherited IRA, liquidate it, or disclaim it, beneficiaries must carefully consider their financial goals and tax implications.

Knowing the distribution rules, taxation, and the advantages of retaining the account with the original custodian are essential in making informed decisions.

By seeking guidance from financial advisors and understanding the specific circumstances surrounding the inheritance, beneficiaries can navigate the complexities of inheriting a 403(b) account effectively.

I am constantly seeking new challenges and opportunities to make a positive impact through my work. With my passion for innovation and drive for success, i continues to push the boundaries of what is possible in the ever-evolving world of technology.

In addition to my technical skills, I am known for my strong communication and leadership abilities. I thrives in collaborative environments, where i can leverage my expertise to drive projects forward and inspire teams to achieve their goals.