INTRODUCTION

Have you ever glanced at your bank statement and noticed a puzzling entry labeled PNP BILLPAYMENT Understanding this charge is key to managing your finances. Let’s explore what exactly the PNP BILLPAYMENT Charge signifies and how it impacts your banking experience.

Unlock the mystery behind your bank statement’s PNP BILLPAYMENT Charge and discover the hidden secrets of your online transactions.

The PNP BILLPAYMENT charge on your bank statement indicates a transaction processed through the Plug’n Pay payment gateway. This charge may represent various online activities such as purchases, bill payments, subscription fees, or donations made securely online. Understanding this charge helps you track your financial transactions and ensures the security of your online payments.

What are PNP Online Payments?

PNP Online Payments are transactions processed securely through Plug’n Pay, a trusted payment gateway used by businesses for electronic transactions. This service allows you to make purchases, pay bills, or subscribe to services online with confidence, knowing your financial information is encrypted and protected.

Whether you’re buying clothes, renewing a subscription, or settling utility bills, PNP Online Payments streamline the process, making it convenient and secure. This payment method ensures that your transactions are processed efficiently and your sensitive information remains safeguarded throughout the process.

With PNP Online Payments, you can enjoy the convenience of digital transactions while having peace of mind about the security of your financial data. It’s a modern way to manage your payments online, providing a seamless experience with top-notch security measures in place.

Are PNP fees refundable?

PNP fees’ refundability depends on the policies of the specific service or business associated with the charge. Generally, online payment platforms, including Plug’n Pay, follow the refund policies set by the merchants or service providers. Reviewing the terms and conditions of the transaction or contacting the service provider’s customer support can provide clarity on refund policies.

How to Identify Legitimate PNP BILLPAYMENT Transactions

- Check your purchase history to confirm the transaction.

- Match the charge with receipts or confirmation emails.

- Ensure the transaction aligns with services or products you acquired.

- Look for familiar merchants or service providers associated with the charge.

- If uncertain, contact your bank or the service provider for clarification.

Tips for Avoiding Unnecessary PNP BILLPAYMENT Charges

- Monitoring Transactions Regularly review your bank statements to identify any unfamiliar PNP BILLPAYMENT charges. This allows you to promptly address any unauthorised transactions or billing errors.

- Maintaining Records Keep detailed records of your online purchases, subscriptions, and bill payments to reconcile them with your bank statements. This helps ensure that all PNP BILLPAYMENT charges are legitimate and expected.

- Reviewing Subscription Services Periodically review your subscriptions to assess whether you still need or use them. Cancelling unused subscriptions can help avoid recurring PNP BILLPAYMENT charges for services you no longer require.

- Securing Payment Information Take steps to protect your payment information, such as using secure websites for online purchases and avoiding sharing sensitive details over unsecured networks. This helps prevent unauthorised transactions and potential PNP BILLPAYMENT charges resulting from fraud.

- Contacting Customer Support If you encounter any issues with PNP BILLPAYMENT charges, promptly contact the merchant or service provider associated with the transaction. Clarifying billing discrepancies or disputing unauthorised charges can help resolve issues and prevent future occurrences.

By implementing these tips, individuals can minimise the risk of encountering unnecessary PNP BILLPAYMENT charges and maintain control over their financial transactions.

Recomended post: What Is CCI CARE.COM Charge on Bank Statement | Explained

Understanding the PNP BILLPAYMENT Charge

Understanding the PNP BILLPAYMENT charge is like unlocking a digital payment puzzle. It simply means a transaction was processed securely through Plug’n Pay, a trusted gateway for online payments. So, when you see this on your bank statement, it’s just confirming that you’ve made a safe electronic purchase or payment.

How does PNP Bill Payment appear on my bank statement?

PNP Bill Payment appears on your bank statement as a transaction processed through Plug’n Pay, a secure payment gateway used by businesses. It’s typically listed as “PNP BILLPAYMENT,” indicating that you’ve made an electronic purchase or payment.

This charge can encompass various transactions, such as online shopping, subscription renewals, or utility bill payments, all securely processed through the Plug’n Pay platform. So, when you spot this entry on your statement, it’s just confirming your digital spending journey through a trusted payment gateway.

What should I do if I see an unknown PNP Bill Payment charge on my bank statement?

- Review your recent online transactions to identify any purchases or payments you may have forgotten.

- Check if the charge corresponds to a legitimate service or product you acquired.

- Contact your bank’s customer service to inquire about the nature of the charge and seek clarification.

- If the charge remains unexplained, consider disputing it with your bank and request further investigation.

- Monitor your account for any additional unfamiliar charges and report them promptly for resolution.

- Take precautionary measures such as updating your account passwords and reviewing security settings to prevent unauthorised transactions in the future.

How can I identify the source of the PNP Bill Payment charge?

1. Review Recent Transactions

Check your recent online purchases, subscriptions, and bill payments to see if any match the amount and timing of the PNP Bill Payment charge.

2. Cross-reference Receipts or Confirmation Emails

Look for receipts or confirmation emails from merchants or service providers associated with the transaction. This can help confirm the legitimacy of the charge.

3. Contact Customer Service

If you’re still unsure about the origin of the charge, reach out to your bank’s customer service for assistance. They can provide more information and help you identify the source of the transaction.

How Can I Resolve an Unrecognized PNP Bill Payment Charge?

1. Review Your Transactions

Check your recent online purchases and payments to see if you can identify the source of the charge. Look for any transactions that match the amount and timing of the PNP Bill Payment.

2. Contact Your Bank

If you’re unable to recognize the charge, contact your bank’s customer service as soon as possible. Inform them about the unrecognised transaction and provide any relevant details you have, such as the transaction amount and date.

3. Dispute the Charge

Request to dispute the unrecognised charge with your bank. They will investigate the transaction and may temporarily refund the amount while they conduct their investigation.

4. Monitor Your Account

Keep a close eye on your bank account for any further unrecognised charges. Report any suspicious activity to your bank immediately to prevent any potential fraud or unauthorised transactions.

5. Update Security Measures

Consider updating your account passwords and enabling additional security features to protect your account from unauthorised access or fraudulent transactions in the future.

Are There Alternative Payment Methods to PNP Bill Payment?

1. Credit/Debit Cards

You can use your credit or debit card directly on merchant websites or through online payment gateways to make purchases.

2. Digital Wallets

Services like PayPal, Apple Pay, Google Pay, and others allow you to link your bank account or credit/debit card and make payments securely online.

3. Bank Transfers

Some merchants offer the option to pay via bank transfer, where you can transfer funds directly from your bank account to the merchant’s account.

4. Cryptocurrency

In some cases, merchants accept cryptocurrency as a form of payment, allowing you to make purchases using Bitcoin, Ethereum, or other digital currencies.

5. Cash

For certain transactions, especially in-person purchases, you can pay with cash if the merchant accepts it as a form of payment.

These alternative payment methods offer flexibility and convenience, allowing you to choose the option that best suits your preferences and needs.

How Quickly Can I Expect PNP Bill Payment Deductions to Occur?

PNP Bill Payment deductions typically occur quickly, often within a few business days of initiating the transaction. However, the exact timing can vary depending on factors such as the processing speed of the merchant or service provider, the payment method used, and the policies of your bank.

In some cases, the deduction may appear immediately, especially for online purchases or bill payments processed in real-time. It’s advisable to check your bank account regularly after making a PNP Bill Payment to monitor the timing of deductions and ensure they occur as expected.

Why Do Banks Want You to Use Bill Pay?

1. Convenience

Bill pay services streamline the process of paying bills by allowing customers to schedule payments electronically. This convenience saves time and effort compared to writing and mailing physical checks or making in-person payments.

2. Cost Savings

Processing electronic payments is often more cost-effective for banks compared to handling paper checks. By promoting bill pay services, banks can reduce their operational costs associated with traditional payment methods.

3. Customer Retention

Offering convenient bill pay services can enhance customer satisfaction and loyalty. When customers have a positive experience with their bank’s bill pay system, they are more likely to continue using other banking products and services.

4. Security

Electronic bill pay services typically incorporate robust security measures to protect customers’ financial information. By encouraging the use of these secure payment methods, banks aim to mitigate the risk of fraud and unauthorised transactions.

Overall, banks promote bill pay services to provide customers with a convenient, cost-effective, and secure way to manage their finances and payments.

What Is Plug’n Pay?

Plug’n Pay is a secure payment gateway that facilitates electronic transactions for businesses. It acts as an intermediary between customers, merchants, and financial institutions, ensuring the secure transmission of sensitive financial information during online purchases, bill payments, and subscription renewals.

Essentially, Plug’n Pay serves as a trusted platform that enables businesses to accept various forms of electronic payments, such as credit cards, debit cards, and digital wallets, while prioritising the security and privacy of customer data.

What Charges Can Appear Under Plug’n Pay?

1. PNP BILLPAYMENT

This charge typically represents payments made for online purchases, subscription fees, or utility bill payments processed through the Plug’n Pay platform.

2. Transaction Fees

Merchants using Plug’n Pay may incur transaction fees for processing payments through the gateway. These fees can vary depending on factors such as transaction volume and the type of payment method used.

3. Monthly Service Fees

Some merchants may be subject to monthly service fees for using Plug’n Pay to accept electronic payments. These fees cover the cost of accessing and utilizing the payment gateway’s services.

4. Integration Fees

Businesses may incur integration fees when integrating Plug’n Pay into their website or software systems. These fees may apply for customization or technical support services provided by Plug’n Pay during the integration process.

Overall, the charges under Plug’n Pay encompass various aspects of electronic payment processing, including transaction processing, monthly service provision, and integration support.

Where PNP Service Can Be Used

1. E-commerce

Online retailers utilise the PNP service to accept payments securely for goods and services purchased through their websites.

2. Subscription Services

Companies offering subscription-based services, such as streaming platforms, software providers, and subscription boxes, can use the PNP service to manage recurring payments from subscribers.

3. Utility Payments

Utility companies, such as electricity, water, and telecommunications providers, may integrate the PNP service to enable customers to pay their bills conveniently online.

4. Nonprofit Organisations

Nonprofits and charitable organisations often leverage the PNP service to accept donations and process contributions securely through their websites.

5. Ticketing and Events

Event organisers, theatres, and venues can utilise the PNP service to sell tickets and process payments for events, concerts, and performances.

Overall, the versatility of the PNP service allows businesses and organisations across various sectors to accept electronic payments securely and efficiently, enhancing the convenience and accessibility of their products and services for customers.

Uses of Plug’ n Pay (PNP)

Recomended also : What Is the OF London GB Bank Charge?

1. Online Payments

Businesses can integrate Plug’n Pay into their websites to accept payments for goods and services purchased online. This includes e-commerce transactions for retail products, digital downloads, and services.

2. Subscription Management

Companies offering subscription-based services, such as streaming platforms, software providers, and membership sites, can utilise Plug’n Pay to manage recurring payments from subscribers automatically.

3. Bill Payments

Plug’n Pay can be used by utility companies, telecommunications providers, and other service providers to enable customers to pay bills conveniently online. This includes bills for electricity, water, internet, cable TV, and other services.

4. Donations and Fundraising

Nonprofit organisations and charities can leverage Plug’n Pay to accept donations and process contributions securely through their websites. This simplifies the donation process for supporters and helps organisations raise funds more effectively.

5. Event Ticketing

Event organisers, theatres, concert venues, and sports teams can use Plug’n Pay to sell tickets for events, performances, and sporting matches online. This allows customers to purchase tickets quickly and securely from the comfort of their homes.

Overall, Plug’n Pay provides a versatile platform for businesses and organisations to accept electronic payments, manage subscriptions, process bill payments, collect donations, and sell tickets online, enhancing convenience for both merchants and customers.

Contact point of Plug’ n Pay (PNP)

1. Phone

You can reach Plug’n Pay’s customer service by calling their dedicated phone number. This information is typically available on their website or in the documentation provided when you sign up for their services.

2. Email

Alternatively, you can send an email to Plug’n Pay’s customer support team. They usually have a dedicated email address for customer inquiries and support requests.

3. Online Support Portal

Many payment service providers, including Plug’n Pay, offer an online support portal where you can find answers to frequently asked questions (FAQs), access user guides and documentation, and submit support tickets for assistance.

4. Social Media

Some companies, including Plug’n Pay, may also provide customer support through social media channels such as Twitter or Facebook. You can send them a direct message or tag them in a post for assistance.

By reaching out to Plug’n Pay’s customer service team through these contact points, you can get assistance with any questions, issues, or technical problems you may encounter while using their services.

What Is Bill Payment in Banking?

Bill payment in banking refers to the process of settling financial obligations or invoices using funds from a bank account. It allows customers to conveniently pay bills, such as utilities, credit card balances, loans, and other expenses, without the need for paper checks or in-person transactions.

Bill payment services provided by banks typically offer various methods for customers to initiate payments, including online banking platforms, mobile apps, and automated systems. By utilising bill payment services, customers can manage their finances more efficiently, track their expenses, and ensure timely payments to avoid late fees or penalties.

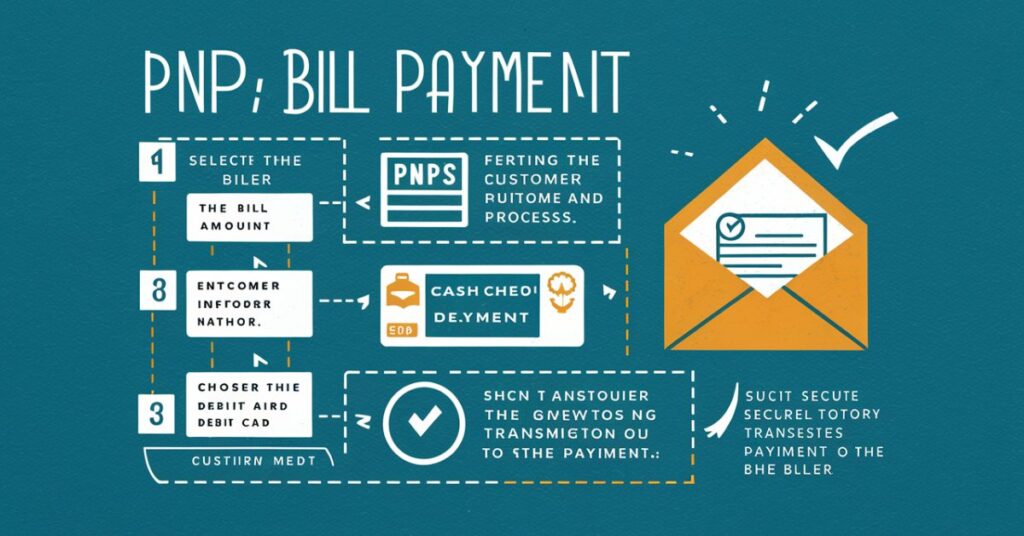

How Pnp Bill Payment Works?

1. Initiation

The process begins when you make a payment online or through a merchant’s website that utilises the Plug’n Pay payment gateway. This could be for purchasing goods or services, paying bills, or subscribing to a service.

2. Transaction Processing

When you initiate the payment, your transaction details are securely transmitted to Plug’n Pay’s servers. Plug’n Pay then verifies the transaction details and securely communicates with your bank or financial institution to authorise the payment.

3. Authorization

Your bank or financial institution receives the payment authorization request from Plug’n Pay and verifies the availability of funds in your account. If the funds are available and the transaction is approved, your bank authorised the payment.

4. Payment Settlement

Once the payment is authorised, Plug’n Pay processes the payment and settles the transaction. This involves transferring the funds from your bank account to the merchant’s account, completing the payment process.

5. Confirmation

After the payment is settled, you receive a confirmation of the transaction, either on the merchant’s website or via email. The merchant also receives confirmation of the payment, allowing them to fulfil your order or service request.

Overall, PNP Bill Payment works seamlessly to facilitate secure electronic transactions between customers, merchants, and financial institutions, ensuring that payments are processed efficiently and securely.

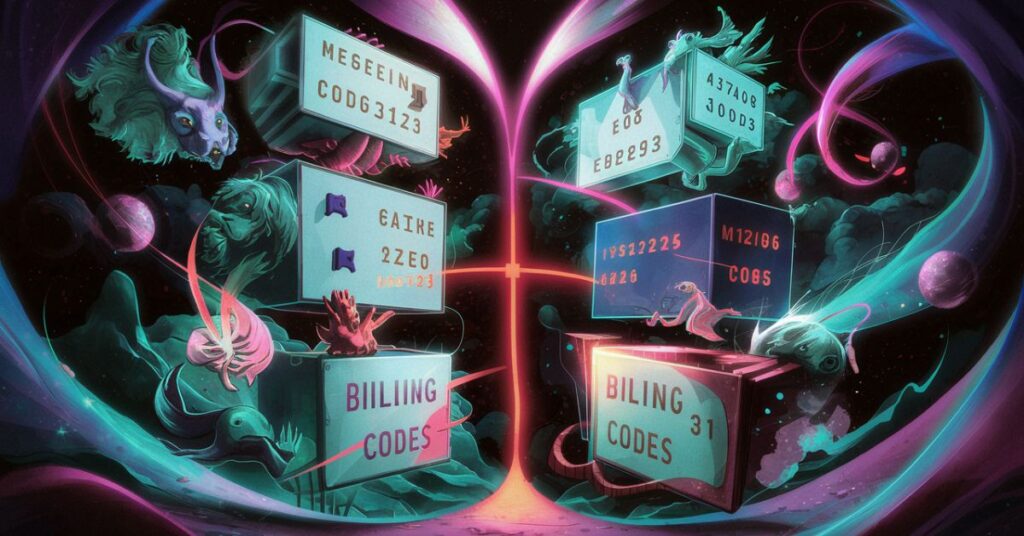

Comparisons With Other Billing Codes

1. PNP vs. ACH

Automated Clearing House (ACH) payments are electronic transfers between banks, often used for direct deposits and recurring payments. While ACH payments involve direct bank-to-bank transfers, PNP Bill Payment typically involves transactions processed through a payment gateway, offering greater flexibility for online purchases and payments.

2. PNP vs. POS

Point of Sale (POS) transactions occur when you make a purchase using a debit or credit card at a physical store. In contrast, PNP Bill Payment involves online transactions processed through a payment gateway, allowing for secure electronic payments for online purchases, bill payments, and subscription services.

3. PNP vs. EFT

Electronic Funds Transfer (EFT) encompasses a broad range of electronic transactions, including ACH payments, wire transfers, and card-based payments. While PNP Bill Payment falls under the umbrella of EFT, it specifically refers to transactions processed through a payment gateway for online purchases and payments.

In summary, while PNP Bill Payment shares similarities with other billing codes in the realm of electronic payments, it stands out for its focus on facilitating secure online transactions through a payment gateway, offering convenience and flexibility for digital commerce.

Common Issues And Concerns

1. Billing Discrepancies

Customers may encounter discrepancies between the amount charged and the expected cost of goods or services. This can result from errors in transaction processing or misunderstandings between merchants and customers.

2. Unauthorised Charges

Unauthorised or fraudulent charges may appear on bank statements, indicating potential security breaches or unauthorised access to payment information. Promptly reporting such charges to the bank is essential to prevent further unauthorised transactions.

3. Technical Glitches

Technical issues with payment gateways or banking systems can lead to failed transactions, delays in payment processing, or incorrect billing. Resolving these issues may require coordination between banks, payment processors, and merchants.

4. Customer Support

Inadequate customer support or difficulty reaching customer service representatives can exacerbate frustrations when attempting to resolve billing issues or disputes. Access to responsive and knowledgeable support is crucial for addressing customer concerns effectively.

5. Refund Processing

Delays or complications in refund processing can frustrate customers seeking reimbursement for cancelled orders, returned merchandise, or billing errors. Clear communication and timely resolution of refund requests are essential for maintaining customer satisfaction.

Addressing these issues requires effective communication between customers, merchants, payment processors, and financial institutions, along with robust security measures to protect against fraud and unauthorised transactions.

Creating A Pnp Account

1. Visit the Plug’n Pay Website

Go to the official Plug’n Pay website using your web browser.

2. Sign Up or Register

Look for an option to sign up or register for a new account. This is typically found on the homepage or in the navigation menu.

3. Provide Your Information

Fill out the registration form with your personal and business information. This may include your name, email address, business name, address, and contact details.

4. Verify Your Email

After submitting the registration form, check your email inbox for a verification email from Plug’n Pay. Follow the instructions in the email to verify your email address and activate your account.

5. Set Up Your Account

Once your email is verified, log in to your Plug’n Pay account using the credentials you provided during registration. Follow the on-screen prompts to set up your account preferences, payment options, and any additional settings.

6. Complete Verification

Depending on your business type and the services you plan to use, Plug’n Pay may require additional verification steps, such as providing documentation or verifying your identity. Follow any instructions provided to complete the verification process.

7. Start Accepting Payments

Once your account is set up and verified, you can start accepting payments through Plug’n Pay. Integrate the Plug’n Pay payment gateway into your website or online store to begin processing electronic payments securely.

By following these steps, you can create a Plug’n Pay account and start accepting payments online efficiently and securely.

Why Might You See a Plug’n Pay Charge on Your Card?

1. Online Purchases

If you’ve made an online purchase from a merchant that uses Plug’n Pay as their payment gateway, the charge on your card could be for the goods or services you bought.

2. Subscription Payments

If you’re subscribed to a service or membership that uses Plug’n Pay to process recurring payments, such as streaming subscriptions or software licences, the charge could be for your subscription renewal.

3. Bill Payments

Some companies and service providers use Plug’n Pay to accept online bill payments, such as utility bills, insurance premiums, or membership dues. The charge on your card could be for one of these bills.

4. Donations

If you’ve made a donation to a nonprofit organisation or charity through a website that utilises Plug’n Pay for donations, the charge on your card could be for your contribution.

Overall, seeing a Plug’n Pay charge on your card typically indicates that you’ve made a secure online transaction or payment using a merchant or service provider that utilises the Plug’n Pay payment gateway.

Why You See a PNP Bill Payment Charge on Monthly Statement

1. Online Purchases

The charge could be for goods or services you purchased online from a merchant that uses Plug’n Pay as their payment gateway. This includes purchases made on e-commerce websites or through online stores.

2. Subscription Renewals

If you’re subscribed to a service or membership that uses Plug’n Pay to process recurring payments, such as streaming subscriptions or software licences, the charge could be for your subscription renewal.

3. Bill Payments

Some companies and service providers use Plug’n Pay to accept online bill payments, such as utility bills, insurance premiums, or membership dues. The charge on your statement could be for one of these bills.

4. Donations

If you’ve made a donation to a nonprofit organisation or charity through a website that utilises Plug’n Pay for donations, the charge on your statement could be for your contribution.

Overall, encountering a PNP Bill Payment charge on your monthly statement signifies that you’ve made a secure online transaction or payment using a merchant or service provider that utilises the Plug’n Pay payment gateway.

What to Do If You Don’t Recognize a PNP Bill Payment Charge

1. Review Your Transactions

Check your recent online purchases and payments to see if you can identify the source of the charge. Look for any transactions that match the amount and timing of the PNP Bill Payment.

2. Cross-reference Receipts or Emails

Look for receipts or confirmation emails from merchants or service providers associated with the transaction. This can help confirm the legitimacy of the charge.

3. Contact Your Bank

If you’re still unsure about the origin of the charge, contact your bank’s customer service. They can provide more information and help you identify the source of the transaction.

4. Dispute the Charge

If you believe the charge is unauthorised or fraudulent, you can dispute it with your bank. They will investigate the transaction and may temporarily refund the amount while they conduct their investigation.

5. Monitor Your Account

Keep a close eye on your bank account for any further unrecognised charges. Report any suspicious activity to your bank immediately to prevent any potential fraud or unauthorised transactions.

By taking these steps, you can address any concerns about unrecognised PNP Bill Payment charges on your statement and ensure the security of your financial accounts.

Can I trust the security of transactions processed through Plug’n Pay?

Yes, you can trust the security of transactions processed through Plug’n Pay. Plug’n Pay is designed as a secure payment gateway that employs robust security measures to protect sensitive financial information.

Here are some reasons why you can trust the security of transactions processed through Plug’n Pay:

1. Encryption

Plug’n Pay uses encryption technology to secure the transmission of data between the customer, merchant, and financial institution. This ensures that sensitive information, such as credit card numbers and personal details, is protected from unauthorised access.

2. PCI Compliance

Plug’n Pay is PCI DSS (Payment Card Industry Data Security Standard) compliant, meaning it adheres to industry standards for securely processing and storing payment card data. Compliance with these standards ensures that transactions are processed in a secure environment.

3. Fraud Prevention

Plug’n Pay implements advanced fraud prevention measures, such as address verification and card security code validation, to detect and prevent fraudulent transactions. These measures help safeguard against unauthorised use of payment cards.

4. Secure Hosting

Plug’n Pay employs secure hosting facilities and data centres with stringent physical and logical security controls to protect against data breaches and unauthorised access to servers.

Overall, Plug’n Pay is committed to providing a secure payment processing platform, ensuring that transactions are conducted safely and securely. As a result, you can have confidence in the security of your transactions when using Plug’n Pay.

Common Issues and Concerns

1. Billing Discrepancies

Customers may encounter discrepancies between the amount charged and the expected cost of goods or services. These discrepancies can result from errors in transaction processing or misunderstandings between merchants and customers.

2. Unauthorised Charges

Customers may discover unauthorised or fraudulent charges on their bank statements, indicating potential security breaches or unauthorised access to payment information. Promptly reporting such charges to the bank is essential to prevent further unauthorised transactions.

3. Technical Glitches

Technical issues with payment gateways or banking systems can lead to failed transactions, delays in payment processing, or incorrect billing. Resolving these issues may require coordination between banks, payment processors, and merchants.

4. Customer Support

Inadequate customer support or difficulty reaching customer service representatives can exacerbate frustrations when attempting to resolve billing issues or disputes. Access to responsive and knowledgeable support is crucial for addressing customer concerns effectively.

5. Refund Processing

Delays or complications in refund processing can frustrate customers seeking reimbursement for cancelled orders, returned merchandise, or billing errors. Clear communication and timely resolution of refund requests are essential for maintaining customer satisfaction.

Addressing these issues requires effective communication between customers, merchants, payment processors, and financial institutions, along with robust security measures to protect against fraud and unauthorised transactions.

Comparisons with Other Billing Codes

1. PNP vs. ACH

While PNP transactions involve payments processed through a payment gateway, Automated Clearing House (ACH) transactions are direct bank-to-bank transfers. PNP is typically used for online purchases, subscriptions, and bill payments, whereas ACH is often used for direct deposits and recurring payments.

2. PNP vs. POS

Point of Sale (POS) transactions occur when you make purchases using a card at physical stores, whereas PNP transactions are conducted online through a payment gateway. POS transactions involve card-present transactions, while PNP transactions involve card-not-present transactions, offering different levels of security and convenience.

3. PNP vs. EFT

Electronic Funds Transfer (EFT) encompasses various electronic transactions, including ACH payments, wire transfers, and card-based transactions. PNP transactions fall under the umbrella of EFT but specifically refer to transactions processed through a payment gateway for online purchases and payments.

In summary, while PNP transactions share similarities with other billing codes in the realm of electronic payments, they differ in terms of payment method, transaction type, and processing mechanism, offering unique benefits and functionalities for both merchants and customers.

Banking Feature

One prominent banking feature is mobile banking, which enables customers to manage their finances conveniently from their smartphones or tablets. With mobile banking apps, users can check account balances, view transaction history, transfer funds between accounts, pay bills, deposit checks remotely, and even manage their budgets through personalised financial tools. This feature provides unparalleled accessibility and flexibility, allowing customers to conduct banking transactions anytime, anywhere, without the need to visit a physical branch.

Final Thoughts

The navigating world of electronic payments, especially when encountering Plug’n Pay charges, requires understanding the intricacies of billing codes, transaction processes, and security measures. While encountering unfamiliar charges or facing common issues can be daunting,

Staying vigilant, promptly addressing concerns, and leveraging customer support resources are crucial for maintaining financial security and peace of mind.By familiarising oneself with the workings of Plug’n Pay and similar payment gateways.

Its customers can confidently engage in online transactions, knowing that their payments are processed securely and efficiently. As technology evolves and electronic payments continue to reshape commerce, staying informed and proactive is essential for navigating the ever-changing landscape of digital finance.Ultimately.

By exercising caution, staying informed, and leveraging available resources, customers can harness the convenience and efficiency of electronic payments while safeguarding against potential risks and uncertainties.

FAQ`s

1. What are PNP Online Payments

PNP Online Payments refer to transactions processed through the Plug’n Pay payment gateway, covering online purchases, bill payments, subscription fees, and donations made securely online.

2. Are PNP fees refundable?

Refundability of PNP fees depends on the policies of the specific merchant or service provider associated with the charge. Generally, online payment platforms adhere to refund policies set by merchants.

3. How can I prevent issues with PNP BILLPAYMENT charges?

Stay vigilant in your online transactions, promptly address unrecognised charges, and utilise secure payment methods to minimise the likelihood of problems associated with PNP BILLPAYMENT charges.

4. Can I trust the security of transactions processed through Plug’n Pay?

Yes, Plug’n Pay is designed as a secure payment gateway, employing encryption and other security measures to protect sensitive financial information during transactions.

5. Where can I get assistance with PNP BILLPAYMENT charges?

For inquiries or support regarding PNP BILLPAYMENT charges, you can contact Plug’n Pay’s customer service through phone, email, or online support portal provided by the company.

I am constantly seeking new challenges and opportunities to make a positive impact through my work. With my passion for innovation and drive for success, i continues to push the boundaries of what is possible in the ever-evolving world of technology.

In addition to my technical skills, I am known for my strong communication and leadership abilities. I thrives in collaborative environments, where i can leverage my expertise to drive projects forward and inspire teams to achieve their goals.